|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Latest Refinance Mortgage Rates and What to ExpectRefinancing your mortgage can be a smart financial move, especially when the latest refinance mortgage rates are favorable. This article explores current trends, what to anticipate, and how to get started with refinancing. Current Trends in Refinance Mortgage RatesAs of mid-2025, refinance mortgage rates have been experiencing fluctuations due to several economic factors. It's crucial for homeowners to stay informed about these changes to make the most of refinancing opportunities. Factors Influencing Rates

How to Prepare for RefinancingPreparing for a refinance involves several key steps to ensure you secure the best rate possible. Evaluate Your Financial Situation

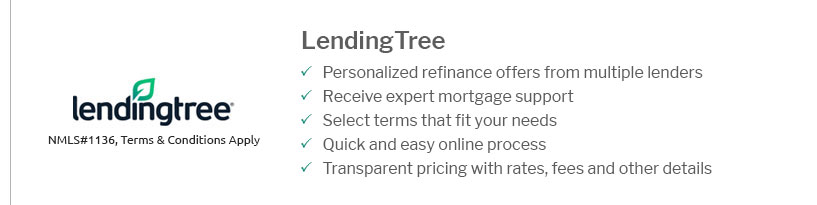

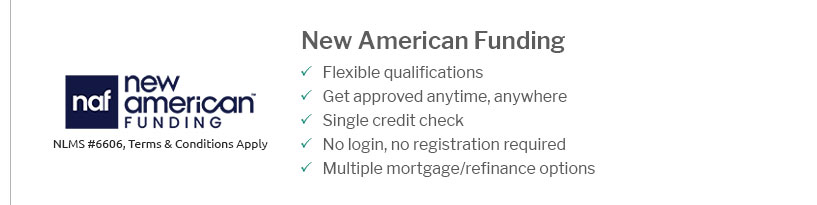

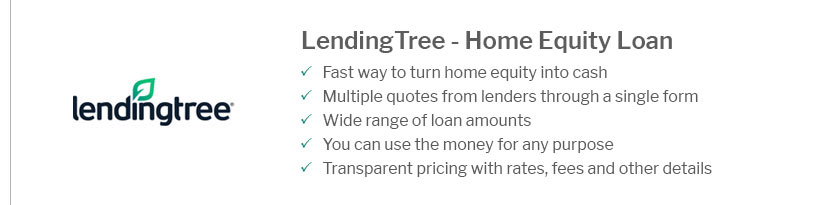

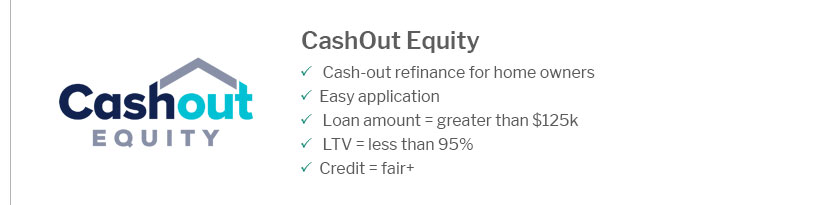

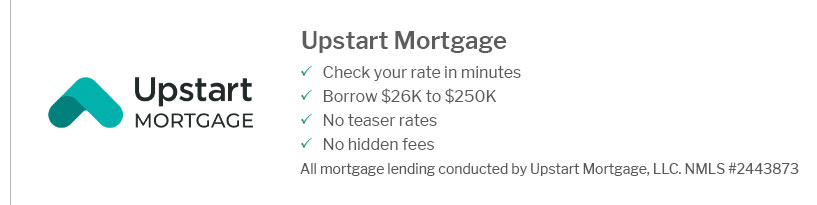

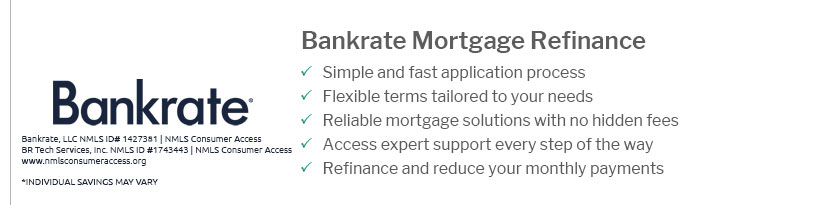

Compare LendersComparing offers from different lenders is crucial. For instance, you can explore home loan interest rates in Ohio to find competitive options in your area. Benefits and Risks of RefinancingRefinancing can offer numerous benefits, but it's essential to weigh them against potential risks. Potential Benefits

Possible RisksWhile refinancing has advantages, there are also risks such as closing costs and extended loan terms that might lead to paying more over time. FAQs About Refinance Mortgage RatesWhat is the typical process for refinancing a mortgage?The process generally involves assessing your finances, applying with a lender, getting an appraisal, and closing the new loan. How often do refinance rates change?Rates can change daily based on market conditions, so it's important to monitor them regularly. Can I refinance if my home value has decreased?Yes, but it may be more challenging. Lenders typically require a certain amount of equity, so consider all options carefully. Understanding the nuances of refinancing and keeping up with the mortgage interest rates refinance today is key to making informed financial decisions. Remember, while refinancing can save money, it's important to evaluate all aspects to ensure it aligns with your financial goals. https://www.rocketmortgage.com/refinance-rates

Today's Rocket Mortgage Refinance Rates ; 30-Year Fixed - 6.625% - 6.955% ; 20-Year Fixed - 6.375% - 6.769% ; 30-Year FHA - 6.49% - 7.392% ; 30-Year Jumbo Fixed - 6.125%. https://www.thirdfederal.com/borrowing/mortgage-refinance

Mortgage Refinance Rates ; 15 Year Fixed Rate, 5.990%, 6.019% ; 3/1 ARM (30 year), 5.990%, 6.387% ; 5/1 ARM (15 year), 6.190%, 6.341% ; 3/1 ARM (15 year), 5.940% ...

|

|---|